Chartered Accountants are highly qualified professionals who handle a wide range of responsibilities within the accountancy spectrum. They are always in demand due to their skills including technical skills & competencies, veracity, and professional standards.

Every company requires CA professionals as they possess an incredible knowledge of financial laws and regulations and can handle monetary issues without worrying about the legal ramifications that might jeopardize the ongoing business.

Pursuing a CA course is a popular choice among students as it equips them with complete knowledge of Financial Management and Auditing, Fiscal Laws, Regulations, Strategic Financial Management, and Ethics, amongst others.

| Percentage Required | 55% for commerce 60% for Arts/humanities/science |

| Duration | 3-3.5 years |

| Eligibility | 55% for Commerce students 60% for arts or science students Must have studied any 3 commerce-related subjects like Accounting, Auditing, Economics, Corporate Laws, Taxation, etc. |

| Fees | 19,000-27,000 INR |

| Process | 1. Directly appear for IPCC 2. After 9 months, complete the Articleship. |

| Syllabus | Business Ethics and Communication Courses, Costing, Taxation, Advanced Accounting Courses, Auditing, Insurance, Information Technology, Strategic Management, etc. |

This Blog Includes:

How to Become a CA?

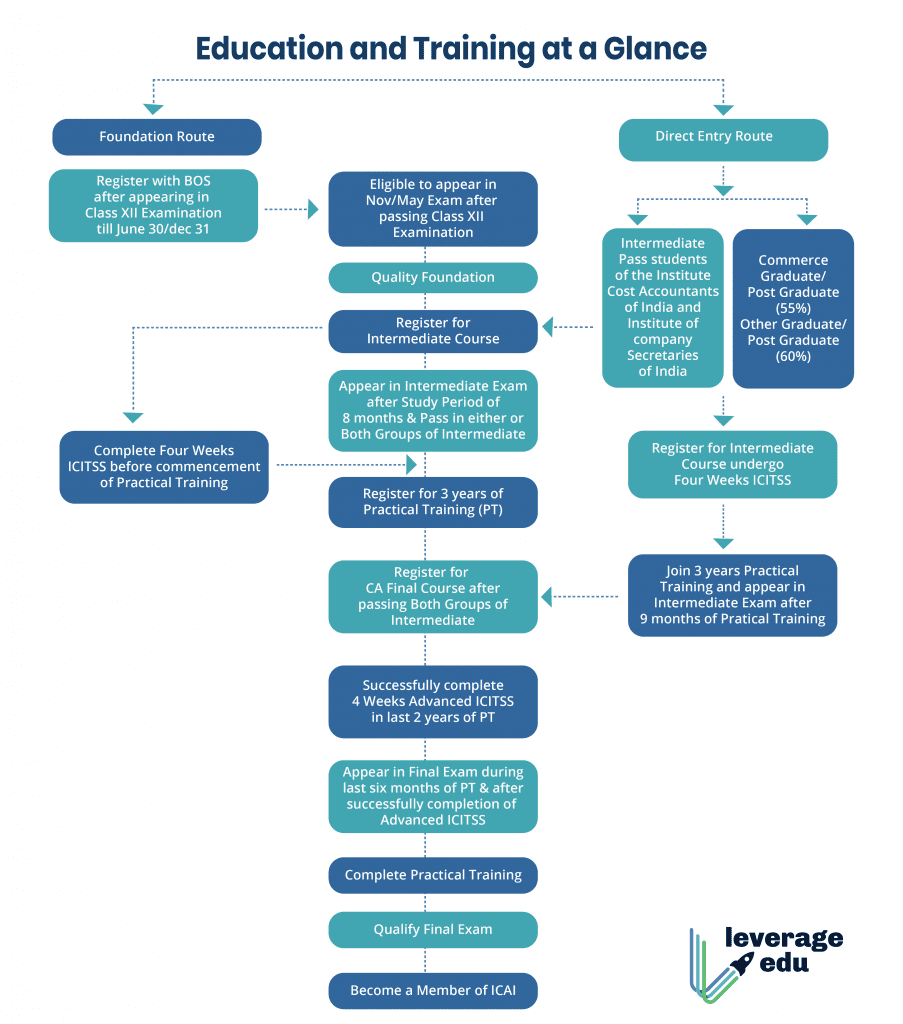

There are two popular ways through which students can aim to obtain a CA qualification. You can pursue this qualification either after completing 12th or attaining a bachelor’s degree.

For those wanting to pursue CA after the 12th, the CPT route, i.e. the erstwhile CA Foundation can be taken. On the other hand, for those wanting to CA after graduation, the direct entry scheme allows them to have the CPT exemption by attaining a specific percentage in their graduate degree.

Here’s how you can pursue CA after 12th and CA After Graduation:

| CA Course | CA After Class 12th | CA After Graduation |

| Minimum Duration | 4.5 Years | 3 Years |

| Level | CPT/CA Foundation | Direct Entry |

| Exception | None | No CPT |

| IPCC Eligibility | 9 months after IPCC | 9 months after Articleship |

| Articleship Eligibility | After Group I of IPCC | After Registration |

Through CPT Route: Completing Class XIIth

Standard 12th appearing/pass-out students who are looking to undertake the CA course have to sit for the Common Proficiency Test (CPT) which has been renamed as CA Foundation. After successfully clearing it, the candidate needs to appear for both groups of the CA IPCC exam and then ultimately for the CA final exam.

Along with this, they will have to complete 9 months of practical training called articles as well. Take a look at the following table for the dates and deadlines for CA Foundation 2024:

| CA Foundation 2024 Events | Important Dates |

| Registration Ends | February 2024 |

| Expected Result Date | June 14 to June 20, 2024 |

| Admit Card | April 2024 |

Why Pursue CA?

CA After Graduation

Here is what you need to know about CA after graduation:

The percentage required for CA after graduation is as follows:

- A minimum of 55% for commerce graduates or postgraduates

- A minimum of 60% for Arts/Humanities/Science graduates or postgraduates

The minimum duration to pursue CA after graduation is 3 years as you can directly take IPCC exams after 9 months from registering yourself after which you also need to complete 2.5-3 Years of Articleship to become a Chartered Accountant.

You can pursue CA after graduation by getting the CPT exemption if you have the specified percentage of marks required to get exempted from the CPT exam and then you can directly begin your articles and further take the IPCC exams.

Eligibility for CA after Graduation

Following are the eligibility requirements you need to fulfil in order to apply for CA after graduation or completing XIIth grade:

- Students must have secured at least 55% marks in their graduation/post-graduation if from a Commerce-related field. Those wanting to study CA after graduation need to have studied at least three commerce-related subjects such as Accounting, Auditing, Economics, Corporate Law, Taxation, and Costing amongst others.

- On the other hand, if your graduation/post-graduation is from a non-commerce background, the minimum marks can climb up to 60%.

- You need to clear the Company Secretary (CS) intermediate exams conducted by the Institute of Company Secretaries of India or the (CWA) intermediate exams conducted by the Institute of Cost Accountants of India.

CA Course Fees

The fees for pursuing a CA after graduation hover around 19,000-27,000 INR. This includes registration fees, article registration fees, orientation course fees and information technology fees. Visit the official ICAI website for more details.

CA After Graduation: Career Prospects

There are a variety of options available for a career in commerce stream. As the CA course structure and curriculum is highly rigorous and incorporate practical training and information technology training, it is highly regarded by companies and recruiters. Further, CAs can also choose to combine their knowledge with other qualifications like MBA, CFA course, FRM Exam, etc. Some of the common career options for CA after graduation have been outlined below.

| Job Profile Expected Salary | |

| Internal Auditor 3.3 Lakh | |

| Cost Accountant 5 Lakh | |

| Tax Specialist 6.8 Lakh | |

| Investment Banker 4.4 Lakh | |

| Asset Manager 9.2 Lakh | |

| Finance Manager 13 Lakh | |

| Tax Auditor 5 Lakh |

CA Direct Entry Scheme after Graduation

A student can sign up for a course to pursue a CA after graduation as well and can appear for the CPT, while CA Foundation exam. This is one of the major reasons why graduate students look for the answers to How to Become a Chartered Accountant.

Candidates with a specific percentage of graduation can directly apply for articles and IPCC Exams. Further, the Direct Entry scheme for CA exempts students from the CPT exam and you can directly appear for the CA Intermediate level exam.

The steps constituting the Direct Entry Scheme of the CA course are mentioned below:

- Enrol for IPCC both groups

- 100 hours of Information Technology Training

- Orientation Course

- Complete 9 months of mandatory Practical Training (Articleship)

- Appearing for both groups of the IPCC exam

- CA Final exam

- Awarding of the CA designation

Also Read: BAF Course

Duration

The duration for the two routes of the CA certification varies, i.e.

- For a student wanting to pursue the CA course after class XIIth, they are required to take the CPT route which spans across a minimum of 4.5 years.

- For a candidate aiming to become a CA after graduation, the Direct Entry route will encompass a minimum of 3 years.

Further, when it comes to the maximum duration, there is no specified period as the number of attempts as well as age limit has been removed by the ICAI.

CA Course Syllabus After Graduation

There are three levels of the exams for the CA course which you need to qualify to attain this sought-after designation. Let’s take a look at these three exam levels and what they entail:

- Common Proficiency Test (CPT): The CPT or CA Foundation is a preliminary accounting exam. It carries 200 marks and tests an individual on the Fundamentals of Accounting, Mercantile Laws, General Economics and Quantitative Aptitude and other important topics that are a part of the CA Foundation Syllabus.

- Integrated Professional Competence (IPCC): Advanced Accounting concepts are specifically dealt with during the two-group IPCC exams. The vast syllabus of IPCC encompasses Business Ethics and Communication, Costing, Taxation, Advanced Accounting, Auditing, health insurance, Information Technology, Strategic Management etc. Students in their final year of graduation are also allowed to appear for this exam.

- CA Final: The final stage of the CA course is the most difficult one to crack. It tests highly complex and advanced topics like Financial Reporting, Professional Ethics, Strategic Finance, Advanced Management, Accountancy, etc. Passing this level paves the way for you to head closer to acquiring the CA certification.

Also Read: Commerce Stream

FAQs

Candidates with a graduate degree need not appear for the CA-CPT, they can directly sit for the IPCC exam. After registering for the same, students have to wait for 9 months to give their first attempt at the examination after doing articleship. The exam is conducted in May and November every year.

On average, the overall duration to complete a CA after graduation is close to 3 years. However, the duration is extended by 6 months with every failed attempt.

Yes, graduate students can become CA. However, they are not required to appear for the CA foundation exam. These candidates are eligible to take the CA intermediate exam after 9 months of professional training.

If you plan on doing CA after graduation, then you need to sit for the CPT exam. You directly have to complete the ITT program followed by 9 months of article ship. Then, you can sit for the IPCC group 1 and 2 examinations.

Yes, one can do CA after completing a BA.

The best way to do CA is to take up the course just after completing class 12th. However, for those who realize this career after completing graduation or midway in their course duration, CA after graduation is a better option!

Yes, graduate students can become CA. However, they are not required to appear for the CA foundation exam. These candidates are eligible to take the CA intermediate exam after 9 months of professional training.

Related Reads

We hope that this blog provides you with an insightful analysis of the CA course and the process of pursuing the CA after graduation.

If you are uncertain about where you should pursue a CA course or look forward to studying other accountant courses, then the AI-enabled algorithm at Leverage Edu can help you select an ideal program that can guide you in tackling the challenging path of a CA.

-

All my doubts are clear thank you

-

Hi Afiya,

Thank you for your feedback!

-

-

Hello,

I have completed M. com on 2013 am am interested to do CA now can you please assist on my query-

Hi Prudhvi, you can directly apply for CA IPCC after completing MCom and there is no age limit for CA so you can take the direct route and achieve this certification. Read our blog on CA IPCC to know more.

-

One app for all your study abroad needs

One app for all your study abroad needs

45,000+ students realised their study abroad dream with us. Take the first step today.

45,000+ students realised their study abroad dream with us. Take the first step today.

23 comments

All my doubts are clear thank you

Hi Afiya,

Thank you for your feedback!

Hello,

I have completed M. com on 2013 am am interested to do CA now can you please assist on my query

Hi Prudhvi, you can directly apply for CA IPCC after completing MCom and there is no age limit for CA so you can take the direct route and achieve this certification. Read our blog on CA IPCC to know more.

Thanks,its very helpful for me and for us.

Very thankful.

Hi Rajni

We are glad that you liked our blog on How to Pursue CA After Graduation.

Who can give us articleship training??.. and when before ipcc oe after ipcc

Hi Sonia,

You can look out for articleship opportunities at any of the national or international level organization. It is generally pursued after completing the second level of the CA course- CA IPCC. To know more about how you can pursue CA after graduation, get in touch with our experts at 1800572000. Meanwhile, check out https://leverageedu.com/blog/ca-ipcc/

Maine 2015 me B.Com pass kiya hai percent kam hai kya mai apply kar sakti hu CA ke liye

Could you tell me how many Marks we wanna to attend IPCC after graduation

Hi Namira,

Get connected with our experts at 1800572000 and resolve all your queries about how you can pursue CA after graduation.

Can I do CA after B.Sc maths

Hi Nathisham, you can study CA after BSc Maths as it is a bachelor’s program and if you have scored a minimum of 60% or above, then you will be directly qualified for the CA IPCC level. To know more about this, check out our blog on CA IPCC: https://leverageedu.com/blog/ca-ipcc/

Can I apply for ca foundation after one year of completion of class 12

Hi Kunga! Yes, you can CA Foundation after 12th!

Sir I want to know that from where we can do articleship for CA. I am so confused about it.

Hi Meenu!

There are a number of firms that offer CA articleship such as Deloitte, PwC, EY & KPMG. You can also use Linkedin to find articleship in your city and state. Hope this helps. If you have more doubts, please connect with us on this number- 1800572000.

Quite useful.

Thanks!

I am working professional works in Central Bank of India in the post of Chief Manager. I did my graduation in mathematics with 68 % after that I completed MBA in marketing and finance and got job in Central Bank of India. I want to enroll in CA.

Hi, Ravi! To enrol in the CA after MBA program, you don’t have to give the entrance examination i.e CA foundation. You can get a direct admission by applying for a CA intermediate exam because you are entering through a direct entry route. We hope this helps! Here you can also go through few of our top reads: How to Become a Chartered Accountant?

CA Course

If you are looking forward to pursue CA abroad, contact the Leverage Edu experts on 1800 57 2000 and sign up for the free counselling sessions!

I completed my bcom on 2019 I am interested to do can you please assist on my quiry

Currently ,i am pursuing mba but i want to do CA after mba .what are steps to complete CA. duration to complete CA