The first chapter of Accountancy class 11, namely, Introduction to Accounting acquaints students with a new and one of the most important commerce stream subjects. This provides aims to establish a foundation for the students who aspire to make a career in Finance and Accounting. Comprising the basics of Accounting to introducing the learner to the advanced-level concepts, this chapter thoroughly covers this specialised discipline in a simpler manner. If you are preparing for your Accountancy exam for Class 11 or just familiarizing yourself with the basic concepts of this topic, this blog elaborates upon this chapter collating the study notes you must go through to ace this topic!

This Blog Includes:

- What is Accountancy?

- Fundamentals of Accountancy

- Objective of Accountancy

- Features of Accountancy

- Branches of Accountancy

- Difference Between Bookkeeping and Accounting

- Introduction to Accounting Summary

- Practice Questions

- Introduction to Accounting Class 11 Slideshare PPT

- Introduction to Accounting Questions and Answers

Introduction to Accounting Class 11 NCERT PDF

Introduction to Accounting Class 11 TS Grewal PDF

Credits: FDocuments

What is Accountancy?

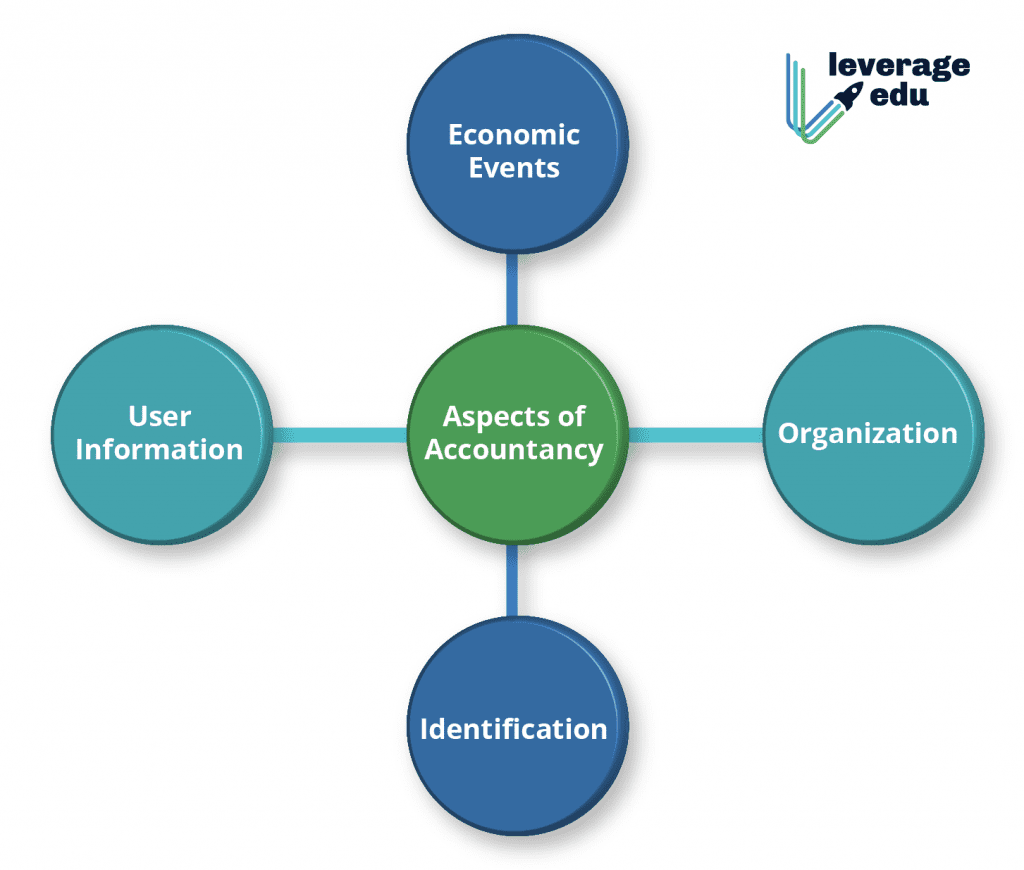

Chapter 11- Introduction to Accounting begins with a simple definition of this discipline. Accounting is referred to as the process of recording, interpreting, reporting, and summarizing financial data. Accounting and bookkeeping play a central role in helping the management to help them make the right decisions as per the current financial status of the company. In other words, accountancy can be referred to as the language of finance. Here are the four prime aspects of accountancy:

- Economic Events

- Organization

- User Information

- Identification

Let us understand the crucial elements of accounting mentioned above in the image-

Economic Events

Economic events take place when a company is involved in several monetary transactions. For instance, purchasing new equipment and machinery, on-site installation, and transportation.

Organization

The concept of Organization is another essential aspect of the Class 11 chapter on introduction to accounting. It is concerned with the business operations and the size of activities.

Identification, Recording, Measurement and Communication

It is essential to establish a system that can identify, record, and measure the financial data. It also involves the process of communicating the right information at the right time to the management.

User Information

User Information is concerned with communicating relevant data to the end-users or consumers. This data will also help them in making informed decisions.

Fundamentals of Accountancy

The primary fundamentals taught in class 11 chapter 1 introduction to accounting are assets, liabilities, and owner’s equity. Mentioned below is a detailed description of these concepts:

Assets

Items of financial value which are possessed by a company are called assets. In other words, any item that can be exchanged for money or can generate income is called an asset. Assets can help an enterprise in paying its debt or expenditure. Students get to learn about how to calculate assets in the next chapter of Accounting Class 11.

Liabilities

The total economic or financial value of a debt or obligation payable by a company to an individual or establishment is called a liability. Liabilities can arise out of the obligations of any previous transaction, which is due for payment by an enterprise. Liabilities can be settled with the help of the assets of the business.

Objective of Accountancy

Now that you are familiar with the basic fundamentals of accounting, let us move on to the objectives elucidated in the chapter. The primary objectives of accountancy are:

- To determine the profits and losses

- To maintain an organized record of all the business transactions

- To give information to all the stakeholders

- To assist the company manage inefficient handling of business operations

- To determine the financial position of the company

Features of Accountancy

Accountancy plays a vital role in giving the right direction to the business activities of a company. Here are the major characteristics of accountancy that students must learn to ace class 11 accountancy chapter, introduction to accounting:

Branches of Accountancy

There are ideally three branches of accountancy that students will learn in their introduction to the accounting chapter. These are financial, management, and cost and these branches correspond to the different types of accounting details and reports are required by different segments like owners, management, shareholders, suppliers, creditors, government agencies, taxation authorities, and so on. These branches of accounting will furnish the financial data to all the relevant segments of an economy.

Financial Accountancy

Financial Accounting is one of the most crucial branches of accounting. It is involved in the process of identifying, evaluating, recording, organizing, and summarizing financial transactions. This data is further communicated to the relevant segments of an enterprise for quick and effective decision making.

Management Accountancy

The concept of management accountancy taught in the introduction to accounting is all about the process of providing financial information to the management for its internal decision-making purposes. This branch exclusively deals with management data needs. Financial data related to cost, funds, profits, and losses are included in this type of accountancy. Financial analysis, cost analysis, budgeting and forecasting, and evaluation of business verdicts are the prime aspects of management accounting.

Cost Accountancy

Cost accounting deals with the process of recording and analyzing the manufacturing costs of a company. The prime motive of this branch is to predict future costs and minimize current expenditures. It also helps in determining the future cost management strategies.

Difference Between Bookkeeping and Accounting

As per Introduction to Accounting, bookkeeping is concerned with the recording of the financial transactions whereas accountancy is all about its interpreting, categorizing, analyzing, summarizing, and reporting. Tabulated below are some prominent differences in both the terms.

| Criteria | Bookkeeping | Accounting |

| Definition | It is related to finding, calculating, recording, financial transactions | It is the process of interpreting, summarizing, and communicating the financial information that is categorized into ledger accounts. |

| Objective | The prime objective of bookkeeping is to facilitate organized data to an enterprise | The prime objective of accountancy is to measure the financial status of the company and communicate the same to relevant authorities |

| Decision Making | The management cannot take concrete decisions based on the data provided by bookkeeping | The management can take critical decisions based on the financial information provided by accountancy |

| Skills Required | No special skills are required | Accountancy requires complex analytical skills |

| Preparation of Financial Statement | There is no need to prepare financial statements during bookkeeping | Financial statements are a crucial part of accountancy |

| Analysis | No analysis of data is required | Bookkeeping data is used to study and analyze financial information |

| Types | Single and double-entry bookkeeping | Financial, management, and cost |

Introduction to Accounting Summary

Accounting is referred to as the process of recording, interpreting, reporting, and summarizing financial data. The primary fundamentals taught are assets, liabilities, and owner’s equity. Items of financial value which are possessed by a company are called assets. The American Institute of Certified Public Accountants(AICPA) defines accounting as “the art of recording, classifying, and summarizing in a significant manner and in terms of money, transactions and events which are, in part at least of financial character, and interpreting the results thereof.” In other words, any item that can be exchanged for money or can generate income is called an asset. The total economic or financial value of a debt or obligation payable by a company to an individual or establishment is called a liability. Accountancy plays a vital role in giving the right direction to the business activities of a company.

Practice Questions

Here are some more questions for you to practice from Introduction to accounting:

- What are the benefits of Accounting?

- What are the limitations of Accounting?

- Who are the primary users of accounting information?

- What are the qualitative features of accounting information?

- Explain the different systems of accounting.

Introduction to Accounting Questions and Answers

Now that we are done with the theoretical part of the introduction to accounting, let us go through some important questions.

Financial Accounting is one of the most crucial branches of accounting. It is involved in the process of identifying, evaluating, recording, organizing, and summarizing financial transactions. This data is further communicated to the relevant segments of an enterprise for quick and effective decision making.

bookkeeping is concerned with the recording of the financial transactions whereas accountancy is all about its interpreting, categorizing, analyzing, summarizing, and reporting

Cost accounting deals with the process of recording and analyzing the manufacturing costs of a company. The prime motive of this branch is to predict future costs and minimize current expenditures. It also helps in determining the future cost management strategies.

Accounting is called the language of business.

The main objective of accounting is keeping accounting records and determine the financial results of the organization.

The three functions of accounting are

Identification

Classification

Communication

Major branches are:

Financial Accounting

Cost Accounting

Management Accounting

Tax Accounting

Forensic Accounting

Luca de Pacioli

Thus, we hope that after going through our study notes on introduction to accounting, you have an insightful overview of this chapter and its components. Are you clueless about which career path to choose after class 12th? Reach out to our experts at Leverage Edu and we will assist you in selecting the right career path as per your interests and career goals.

One app for all your study abroad needs

One app for all your study abroad needs

45,000+ students realised their study abroad dream with us. Take the first step today.

45,000+ students realised their study abroad dream with us. Take the first step today.