If you enjoy the company of numbers and working for long hours along with a zeal to make a career in the world of Finance & Banking, then we might have found the right course for you! Investment Banking is a flourishing field that establishes a connection between investors and corporations. These banking institutes facilitate governments, business horses and institutes with their advisory services. Investment Banking courses provide a lifetime opportunity to enhance your skills. Read this blog to learn more about Investment Banking courses and exceptional career opportunities!

This Blog Includes:

- What are Investment Banker Courses?

- What do Investment Bankers do?

- Eligibility to study Investment Banker Courses

- Top Investment Banking Courses and Universities

- Popular Online Investment Banking Courses

- Investment Banker Course Syllabus

- Skills Required to be an Investment Banker

- Scope of Investment Banker Courses

What are Investment Banker Courses?

Investment Banking prepares a candidate for positions in management and administration.

- These courses educate students on how to plan, coordinate, develop, and implement financial investment plans.

- Investment banking courses look at how experts may assist businesses, organizations, and individuals in managing and growing their financial assets.

- Graduates of an Investment Banking program help firms make educated decisions about how to invest their assets to maximize the value of their holdings.

- Some of the most common Investment Banker occupations are Relationship Associate, Investment Associate, Equity Analyst, and Investment Writer.

- A professional in this sector can expect to earn around INR 5 LPA on average.

What do Investment Bankers do?

The prime responsibility of investment Bankers is to notify their clients on investments and help promote those investments. Their main role is to act as a bridge among brokers and advisors hence assuring the solution of the needs of clients. Enlisted are some of the major roles and responsibilities of Investor Bankers:

- Acts as a liaison between advisor and business managers in order to maintain transactions for clients

- Ensures linking loans structure deals and Interface with corporate finance groups, to negotiate favourable terms and conditions

- Keeping a record of market conditions by analyzing equity capital markets or Debt capital markets in order to obtain equity and fixed income

- Investment Bankers tend to Work in alliances and acquisitions to set up new deals in Capital markets

- Manage transactions in assets, securities, and currencies by working as advisors in capital formation, valuation and risk management

- Facilitate the creation of financing vehicles to redirect cash flows to investors.

- Convey data about specific bonds and securities to institutional investors

- Maintain coherent interface with office managers and the firm’s analysts and traders

Find out how to make a career in Wealth Management!

Eligibility to study Investment Banker Courses

Students can enroll in Investment Banking courses, but they must first determine the worth and cost of the investment banking courses. The following table lists the eligibility criteria for several types of Investment Banking courses available to people.

| Investment Banking Certification Course | A candidate who received 50% in any subject in 10+2 can enroll in certificate-level courses. |

| Diploma in Investment Banking | An applicant with a 50 percent grade point average in class 12 from any background can pursue diploma-level banking courses, but a PG Diploma requires a 50 percent grade point average in a relevant field. |

| UG Level Investment Banking Courses | Students with a minimum of 50% in their 10+2 exams, preferably from a recognized board, can enroll in UG-level investment banking courses. |

| PG Level Investment Banking Courses | For PG-level investment banking courses, a candidate must have a 50 percent merit in (BBA/BCom). |

Martin Zeman

Top Investment Banking Courses and Universities

Top universities across the globe offer a plethora of Investment Banking courses to aspirants. Have a look at some of the popular combinations for the same:

| Course | Institute |

| Investments MSc | University of Birmingham |

| Master of Finance – Corporate Finance and Investment Banking | The University of New South Wales |

| MSc Finance and Investment | University of Exeter |

| Accounting, Finance and Strategic Investment MSc | Newcastle University |

| MSc in Project Analysis, Finance, and Investment | University of York |

| Bachelor of Science in Business Administration- Real Estate Investment Management | University of Texas – Dallas |

| Bachelor of Science in Finance and Investment (Honors) | Coventry University |

| Bachelor of Arts in Finance and Investment with the sandwich year (Honors) | Wharton University |

| International Incorporated Masters- Investment and Banking (Bangor University) | Oxford International Education Group |

| Bachelor of Science in Finance and Investment (Honors) | Coventry University |

What happens after completing Investment Banking courses? Find out with this exclusive blog on Investment Banking Jobs and its Types!

Investments MSc

Trading and investing offers a rewarding career path but also requires a high degree of technical skill and theoretical knowledge of the subject. Investment MSc program is a study of all these theories and techniques of investments, as well as their real-life application. This course offers you a plethora of opportunities for graduates who want to make a career in Investment Banking, or who wish to become Investments Specialists or Managers in other corporate bodies.

Master of Finance – Corporate Finance and Investment Banking

The Corporate Finance and Investment Banking stream is intended for those students who wish to extend their knowledge of Corporate Finance and Investment Banking. This course is aimed at creating values for company shareholders, and corporate advisory in capital management. Further, the curriculum trains students about mergers, spinoffs, acquisitions, and divestitures, restructuring, and control of loss. This Investment Banking course will provide you with all the relevant skills you need to pursue a successful career with a consultancy firm, financial institution, a government department, or an international agency.

Do you know you can pursue Investment Banking courses even after Engineering? To know more about this, read our blog on – Why Banking after Engineering?

MSc Finance and Investment

The program has been affiliated by the Chartered Institute for Securities and Investment (CISI) since 2008 and is considered to be a benchmark for all the Investment Banking courses. MSc in Finance and Investment enables students to develop professional and financial skills and subject expertise that makes you a valuable asset for the companies. This specialist course will suit those who want to pursue a professional career in the financial services sector, in areas such as, insurance, investment, advice, pensions, and wealth management.

BS in Business Administration – Real Estate Investment Management

This Investment Banking course is for those who want to explore the working of the real estate industry. The curriculum is designed to provide the latest developments in investments, risk, financing, and real estate management. It is affiliated to Chartered Institute for Securities & Investment (CISI) and the Chartered Financial Analyst Society of the UK (CFA UK) and accredited by the Chartered Insurance Institute (CII. A Finance and Investment BA can help you gain the skills and confidence to offer sound financial advice that could change someone’s future.

Bachelor of Science in Finance and Investment (Honors)

Bachelor of Science in Finance and Investment course is one of the finest of finance courses offered by the School of Finance, Economics, and Accounting. This course aims to offer students the chance to develop the latest numerical, analytical, and financial skills, combined with the personal and professional skills vital for all the finance professionals.

Popular Online Investment Banking Courses

- The Complete Investment Banking Course

- Introduction to Corporate Finance

- The Complete Financial Ratio Analysis

- Advanced Accounting for Investment Banking

Investment Banker Course Syllabus

The Investment Banking Program lasts two to three years and is broken into semesters. The topics listed in the table are included in the curriculum.

| Micro Economics | Financial Modeling |

| Principles of Management and Organizational Behavior | Business Analysis Tools |

| Quantitative Techniques for Management | Total Quality Management |

| Industrial Project Management | Purchasing and Procurement Management |

| Management Information Systems | Business Environment and Ethics |

| Managerial Economics | Supply Chain Management |

| Information Technology | Project Management & Documentation |

| Corporate Communication | Strategic Management |

| Human Resources Management | Enterprise Resource and Planning |

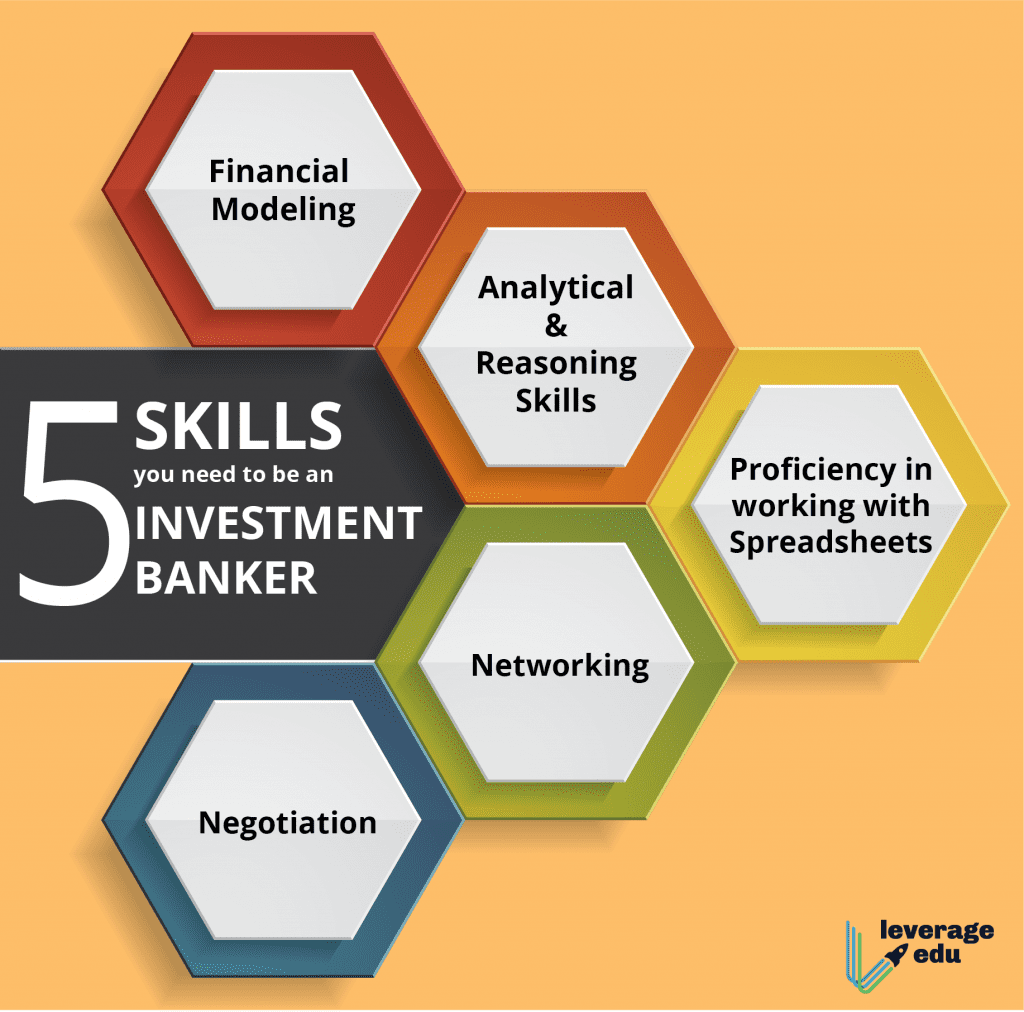

Skills Required to be an Investment Banker

| Investment Product | Discounted Cash Flow |

| Financial Institutions | New Clients |

| Asset Management | Real Estate |

| Financial Models | Client Relationships |

| Capital Equity | Financial Service |

| Mergers | Sell-Side |

| Capital Markets | Due Diligence |

| Financial Market | Financial Statement |

Scope of Investment Banker Courses

Investment banking is a very active degree with a lot of employment options. Any day, one can go from a private organization to a government ministry, such as the Department of Finance. This employment might pay well for those who are efficient and have high technical abilities. Here are a few job descriptions for MBA graduates.

Top Job Profiles & Salary

| Job Role | Average Salary |

| Virtual Investment Banking Assistant | INR 5 Lac to 7 Lac |

| Investor Relations Associate | INR 5.5 Lac to 8 Lac |

| Equity Analyst | INR 3.5 to 8 Lac |

| Investment Consultant | INR 5 to 9 Lac |

| Analyst | INR 4-8 Lac |

| Investment Writer | INR 3 – 6 Lac |

Top Recruiters

| JP Morgan | Realtymogul |

| HSBC Bank | World Education Service |

| Amazon | Morgan Stanley |

| Robert Half | Keybank |

Hope this blog helped you to acquire all the necessary information related to Investment Banking Courses. If you dream to make a career in this field, let Leverage Edu experts guide you through. Book an E-meeting session with us and make your dream a reality!

One app for all your study abroad needs

One app for all your study abroad needs

45,000+ students realised their study abroad dream with us. Take the first step today.

45,000+ students realised their study abroad dream with us. Take the first step today.