Becoming a CA After graduation, highly qualified professionals who handle a wide range of responsibilities within the accountancy spectrum. They are always in demand due to their skills, including technical skills & competencies, veracity, and professional standards.

Every company requires CA professionals as they possess an incredible knowledge of financial laws and regulations and can handle monetary issues without worrying about the legal ramifications that might jeopardise the ongoing business. In this article, we will explain to you how to pursue CA after graduation, including its eligibility and other important things.

This Blog Includes:

- What is CA After Graduation?

- Why Pursue CA After Graduation?

- Eligibility Criteria for CA After Graduation

- Registration Process for Direct Entry Scheme

- CA Course Structure and Syllabus After Graduation

- Duration of CA Course After Graduation

- CA Course Fees After Graduation

- CA After Graduation: Career Prospects

- FAQs

What is CA After Graduation?

CA after graduation refers to enrolling in the CA program via ICAI’s Direct Entry Scheme, allowing qualified graduates to skip the CA Foundation exam and begin at the CA Intermediate level. This streamlined approach is ideal for those with a bachelor’s or master’s degree, reducing the overall time to qualification while maintaining the rigorous standards of the profession.

After graduation, CA focuses on advanced topics in accounting, law, and taxation, preparing you for high-demand roles in the financial sector. Here are the CA course details after graduation:

| Percentage Required | 55% for commerce 60% for Arts/humanities/science |

| Duration | 3-3.5 years |

| Eligibility | 55% for Commerce students 60% for arts or science students Must have studied any 3 commerce-related subjects like Accounting, Auditing, Economics, Corporate Laws, Taxation, etc. |

| Fees | 19,000-27,000 INR |

| Process | 1. Directly appear for IPCC 2. After 9 months, complete the Articleship. |

| Syllabus | Business Ethics and Communication Courses, Costing, Taxation, Advanced Accounting Courses, Auditing, Insurance, Information Technology, Strategic Management, etc. |

Also Read: Diploma Courses After 12th Commerce: Duration, Top Colleges, Jobs

Why Pursue CA After Graduation?

Choosing CA after graduation offers a blend of prestige, stability, and versatility in the finance world. CAs are integral to businesses for their expertise in financial regulations, risk management, and strategic planning. Here is a picture to help you understand why to pursue a CA course:

- High demand across industries like banking, consulting, and corporates.

- Global recognition, enabling international opportunities.

- Lucrative salaries and growth potential.

- Flexibility to combine with qualifications like an MBA or CFA.

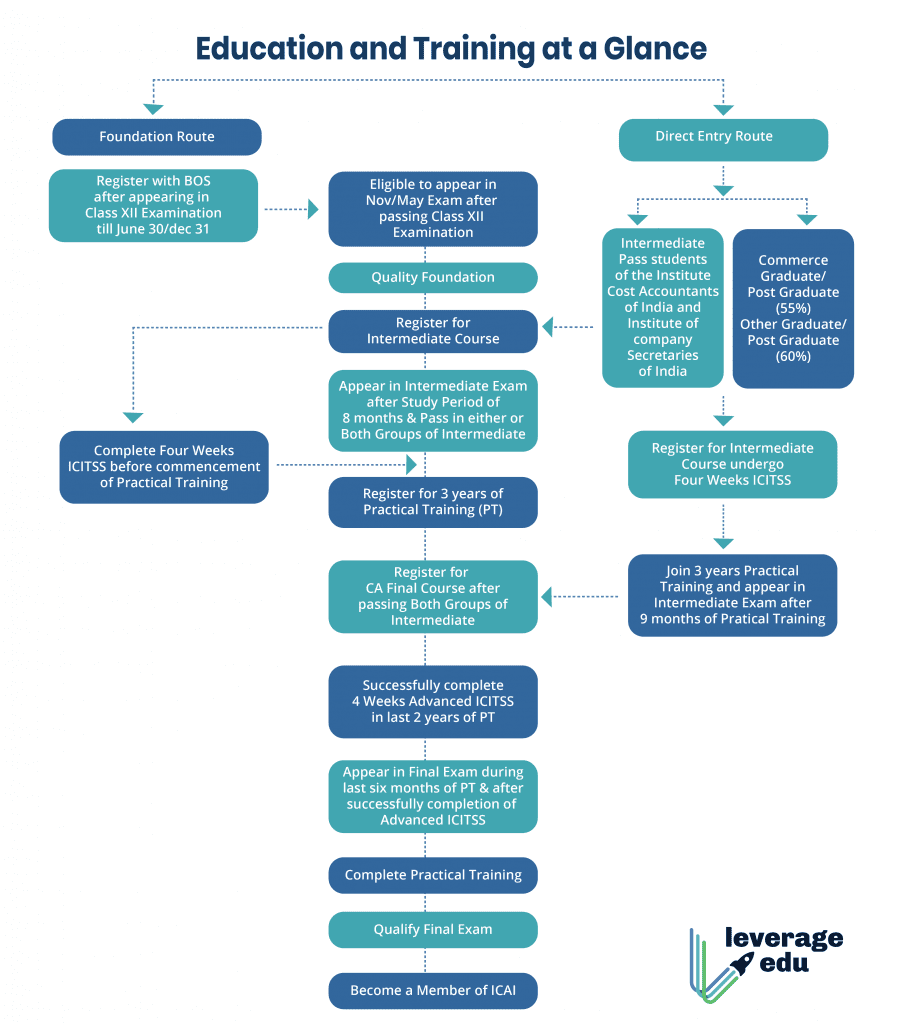

In a dynamic economy, CAs ensure compliance and drive business efficiency. Let’s take an overview of its education and training:

Eligibility Criteria for CA After Graduation

Before registering for CA after graduation, it’s crucial to meet ICAI’s eligibility requirements under the New Scheme. These criteria ensure candidates have a strong academic foundation to handle the program’s demands. Here’s what you need:

- Commerce graduates or postgraduates: Minimum 55% aggregate marks.

- Non-commerce graduates or postgraduates (e.g., Arts, Science, Humanities): Minimum 60% aggregate marks.

- Candidates who have cleared the Intermediate level exams of the Institute of Company Secretaries of India (ICSI) or the Institute of Cost Accountants of India (ICMAI) are also eligible, regardless of percentage.

Note: Marks are calculated based on the aggregate, excluding any grace marks. If you don’t meet these, you can still pursue CA via the Foundation route.

Registration Process for Direct Entry Scheme

The registration process for CA after graduation is straightforward and can be completed online through ICAI’s Self-Service Portal (SSP). This step marks the beginning of your CA journey, requiring document submission and fee payment. Follow these steps:

- Visit the ICAI website (icai.org) and register on the SSP portal.

- Fill out the Intermediate registration form, selecting the Direct Entry option.

- Upload scanned copies of your graduation/postgraduation marksheet, photo, signature, and proof of nationality (if applicable).

- Pay the registration fee online.

- Receive your registration number via email, and start your 8-month study period.

Registration is open year-round, but plan ahead for exam cycles in May and November/January.

CA Course Structure and Syllabus After Graduation

The CA course after graduation under the New Scheme consists of two main levels: Intermediate and Final, plus practical training. The syllabus emphasizes practical application, ethics, and strategic thinking to align with global accounting standards. Below is the detailed structure:

CA Intermediate Syllabus

This level has 6 papers divided into two groups, totaling 600 marks. Each paper is 100 marks, with a mix of objective and descriptive questions.

- Group 1:

- Advanced Accounting: Covers partnership accounts, company accounts, and special transactions.

- Corporate and Other Laws: Includes company law, securities laws, and other economic laws.

- Taxation: Focuses on income tax and goods and services tax (GST).

- Group 2:

- Cost and Management Accounting: Deals with cost control, budgeting, and decision-making.

- Auditing and Ethics: Explores audit processes, standards, and professional ethics.

- Financial Management and Strategic Management: Includes capital budgeting, risk management, and business strategy.

You must pass both groups (minimum 40% per paper and 50% aggregate per group) to proceed.

CA Final Syllabus

The Final level also has 6 papers in two groups, focusing on advanced topics for professional expertise.

- Group 1:

- Financial Reporting: Advanced standards on consolidation, valuation, and reporting.

- Advanced Financial Management: Risk management, derivatives, and portfolio management.

- Advanced Auditing, Assurance, and Professional Ethics: Complex audits, forensics, and ethical dilemmas.

- Group 2:

- Direct Tax Laws and International Taxation: Tax planning, treaties, and compliance.

- Indirect Tax Laws: GST, customs, and excise duties.

- Integrated Business Solutions: Multi-disciplinary case studies involving strategic management.

Exams include case studies to test real-world applications.

Duration of CA Course After Graduation

The duration for CA after graduation via Direct Entry is typically 3 years, assuming first-attempt clearances. This is shorter than the Foundation route due to the exemption. Key timelines include:

- 8 months of study after registration before appearing for Intermediate exams.

- 2 years of practical training (articleship) after passing the Intermediate.

- Final exams can be attempted during the last 6 months of articleship.

There is no maximum duration limit, as ICAI has removed attempt and age restrictions, allowing flexibility for working professionals.

Also Read: BAF Course

CA Course Fees After Graduation

Understanding the fee structure helps in budgeting for your CA journey. Fees under the New Scheme are affordable and exclude coaching costs. We have included the stage-wise fee structure for the CA course. Here’s a breakdown:

| Stage | Fee (Approx.) |

| CA Intermediate (Both Groups) | INR 18,000 |

| ICITSS Training | INR 7,000 |

| Articleship Registration | INR 2,000 |

| CA Final | INR 22,000 |

| Advance ICITSS | INR 7,500 |

Note: Total Estimate Cost: Around INR 56,000- INR 60,000 (excluding coaching fees)

CA After Graduation: Career Prospects

There are a variety of options available for a career in the commerce stream. As the CA course structure and curriculum are highly rigorous and incorporate practical training and information technology training, it is highly regarded by companies and recruiters. Further, CAs can also choose to combine their knowledge with other qualifications like an MBA, CFA course, FRM Exam, etc. Some of the common career options for a CA after graduation have been outlined below.

| Job Profile | Average Starting Salary |

| Tax Specialist | INR 7 to 10 Lakhs |

| Internal Auditor | INR 6 to 9 Lakh |

| Cost Accountant | INR 8 to 12 Lakh |

| Investment Banker | INR 10 to 15 Lakh |

| Asset Manager | INR 9 to 14 Lakh |

| Tax Auditor | INR 8 to 12 Lakh |

In conclusion, pursuing CA after graduation is a smart choice for students who are clear about their career goals. With the Direct Entry Scheme, you can save time by starting from the CA intermediate and moving faster toward becoming a Chartered Accountant. Although the journey is challenging, dedication and proper guidance can help you succeed.

FAQs

Candidates with a graduate degree need not appear for the CA-CPT; they can directly sit for the IPCC exam. After registering for the same, students have to wait for 9 months to give their first attempt at the examination after doing articleship. The exam is conducted in May and November every year.

On average, the overall duration to complete a CA after graduation is close to 3 years. However, the duration is extended by 6 months with every failed attempt.

Yes, graduate students can become a CA. However, they are not required to appear for the CA Foundation exam. These candidates are eligible to take the CA intermediate exam after 9 months of professional training.

If you plan on doing CA after graduation, then you need to sit for the CPT exam. You directly have to complete the ITT program, followed by 9 months of apprenticeship. Then, you can sit for the IPCC groups 1 and 2 examinations.

The best way to do CA is to take up the course just after completing class 12th. However, for those who realise this career after completing graduation or midway through their course duration, CA after graduation is a better option!

Yes, graduate students can become a CA. However, they are not required to appear for the CA Foundation exam. These candidates are eligible to take the CA intermediate exam after 9 months of professional training.

We hope that this blog provides you with an insightful analysis of the CA course and the process of pursuing the CA after graduation. If you are uncertain about where you should pursue a CA course or look forward to studying other accounting courses, then the AI-enabled algorithm at Leverage Edu can help you select an ideal program that can guide you in tackling the challenging path of a CA

One app for all your study abroad needs

One app for all your study abroad needs

60,000+ students trusted us with their dreams. Take the first step today!

60,000+ students trusted us with their dreams. Take the first step today!

25 comments

All my doubts are clear thank you

Hi Afiya,

Thank you for your feedback!

Hello,

I have completed M. com on 2013 am am interested to do CA now can you please assist on my query

Hi Prudhvi, you can directly apply for CA IPCC after completing MCom and there is no age limit for CA so you can take the direct route and achieve this certification. Read our blog on CA IPCC to know more.

Thanks,its very helpful for me and for us.

Very thankful.

Hi Rajni

We are glad that you liked our blog on How to Pursue CA After Graduation.

Who can give us articleship training??.. and when before ipcc oe after ipcc

Hi Sonia,

You can look out for articleship opportunities at any of the national or international level organization. It is generally pursued after completing the second level of the CA course- CA IPCC. To know more about how you can pursue CA after graduation, get in touch with our experts at 1800572000. Meanwhile, check out https://leverageedu.com/blog/ca-ipcc/

Maine 2015 me B.Com pass kiya hai percent kam hai kya mai apply kar sakti hu CA ke liye

Could you tell me how many Marks we wanna to attend IPCC after graduation

Hi Namira,

Get connected with our experts at 1800572000 and resolve all your queries about how you can pursue CA after graduation.

Can I do CA after B.Sc maths

Hi Nathisham, you can study CA after BSc Maths as it is a bachelor’s program and if you have scored a minimum of 60% or above, then you will be directly qualified for the CA IPCC level. To know more about this, check out our blog on CA IPCC: https://leverageedu.com/blog/ca-ipcc/

Can I apply for ca foundation after one year of completion of class 12

Hi Kunga! Yes, you can CA Foundation after 12th!

Sir I want to know that from where we can do articleship for CA. I am so confused about it.

Hi Meenu!

There are a number of firms that offer CA articleship such as Deloitte, PwC, EY & KPMG. You can also use Linkedin to find articleship in your city and state. Hope this helps. If you have more doubts, please connect with us on this number- 1800572000.

Quite useful.

Thanks!

I am working professional works in Central Bank of India in the post of Chief Manager. I did my graduation in mathematics with 68 % after that I completed MBA in marketing and finance and got job in Central Bank of India. I want to enroll in CA.

Hi, Ravi! To enrol in the CA after MBA program, you don’t have to give the entrance examination i.e CA foundation. You can get a direct admission by applying for a CA intermediate exam because you are entering through a direct entry route. We hope this helps! Here you can also go through few of our top reads: How to Become a Chartered Accountant?

CA Course

If you are looking forward to pursue CA abroad, contact the Leverage Edu experts on 1800 57 2000 and sign up for the free counselling sessions!

I completed my bcom on 2019 I am interested to do can you please assist on my quiry

Currently ,i am pursuing mba but i want to do CA after mba .what are steps to complete CA. duration to complete CA

pls mention the age limit for ipcc

Hey Delphine,

The minimum age limit for the CA examination is 18 years. There is no upper age limit. As long as you meet the eligibility criteria, you can pursue CA. For further information, consult the study abroad experts at Leverage Edu. You can also call us at: 1800 57 2000.