Education loan plays an effective role to cope with financial setbacks and provides support to acquire quality education. There are several national and state banks offering excellent education loans along with added benefits that reduce the cost and future burden of these essential investments. One such prominent pathway is the ‘Syndicate Bank Education Loan’.

Here is an insightful blog that will walk you through various aspects of this loan including a step-by-step application process.

| Name of the Bank | Syndicate Bank |

| Merged with | Canara Bank |

| Type of Bank | Nationalised Bank |

| Type of Loan | Education |

| Types of Education Loans | Synd Vidya Educational Loan Synd Vidya Abroad Educational Loan Synd Super Vidya Synd Vidya Vocational Courses Synd Vidya Skill Loan |

| Maximum Amount | Rs 2 crores |

| Loan Disbursement | 15 days |

| Repayment | Upto 15 years + Moratorium |

| Margin | In the case of Loans up to Rs.4 lac – No Margin is required. In case of Loans above Rs.4 lac – 5% for study in India and 15% for study abroad |

| Official Website | https://www.syndicatebank.in/ |

This Blog Includes:

- Syndicate Bank Education Loan

- Types of Syndicate Bank Education Loan

- Interest Rate for Syndicate Bank Education Loan

- Essential Features

- Advantages of Syndicate Bank Education Loan

- Syndicate Bank Education Loan Details

- Syndicate Bank Education Loan Abroad

- Expenses Covered Under Student Loan

- Courses Covered

- How to Apply for Education Loan in Syndicate Bank?

- Syndicate Bank Education Loan Documents

- EMI Payment Methods

- Syndicate Bank Education Loan Repayment Policy

- Syndicate Bank Education Loan Calculator

- Syndicate Bank Education Loan EMI Payment Methods

- Syndicate Bank Education Loan Customer Care Number & Contact Details

- FAQs

Syndicate Bank Education Loan

Syndicate Bank is known to be one of the oldest and major commercial banks in India. Education is a key area where parents are willing to invest in order to build a prosperous and bright future for their children. Syndicate Bank offers extremely effective education loans at easy interest rates. The main objective of the Syndicate Bank Education Loan is to provide financial aid to Indian students who are willing to pursue higher education either in India or abroad.

Types of Syndicate Bank Education Loan

The bank offers the following two education loans to students:

- Synd Vidya Education Loan for students who are enrolling at universities and colleges both in India and abroad.

- Synd Vidya Abroad Education Loan is limited to studying abroad.

- Synd Super Vidya is for professional and technical courses in India or abroad.

- Synd Vidya Vocational Courses is for students who wish to pursue vocational training and skill development courses.

- Synd Vidya Skill Loan is for candidates who want to take up short-term skill development courses.

Interest Rate for Syndicate Bank Education Loan

| Loan Category | Loan Amount | Interest Rate |

| Synd Vidya Education Loan | Up to ₹4 lakh ₹4 lakh – ₹7.5 lakh ₹7.5 lakh – ₹20 lakh | One year MCLR + 1.60% per annum One year MCLR + 1.85% per annum One year MCLR + 2.85% per annum |

| Synd Vidya Abroad Education Loan | ₹20 lakh – ₹2 crore | One year MCLR + 2.10% per annum |

| Synd Super Vidya | ₹3 lakh- ₹20 lakh | One year MCLR +0.10% per annum |

| Synd Vidya Vocational Courses | Up to ₹2 lakh | Interest linked to Base Rate Base Rate+2.25% per annum |

| Synd Vidya Skill Loan | ₹5,000 to ₹. 1.5 lakh | One year MCLR+1.50% per annum |

Essential Features

The following are the key features of education loans provided by Syndicate Bank:

- Syndicate Bank offers a loan amount of up to INR 10 lakh for students pursuing higher education in Indian colleges and up to INR 20 lakh for universities abroad.

- No margin money is required for loans up to INR 4 lakh whereas a 5% margin for loans above INR 4 lakh for studies in Indian colleges and a 15% margin for loans above INR 4 lakh for studies abroad.

- No security is required for loans up to INR 4 lakh while suitable collateral is required with a third-party guarantee for loans between INR 4lakh to INR 7 lakh.

- The bank does not charge any processing fee for availing any of the Syndicate Bank Education Loans.

Advantages of Syndicate Bank Education Loan

Here are the advantages of taking the Syndicate Bank Education loan:

- Low-interest rate

- No pre-closure charges

- Less paperwork

- Faster Disbursal

- No prepayment charges

- No processing fees

Syndicate Bank Education Loan Details

The eligibility criteria for the two offered Syndicate Bank Education Loans differ slightly from each other. Here are the major eligibility criteria for the same:

Synd Vidya Loan Scheme

The candidate applying for the Synd Vidya Education Loan should be an Indian citizen or an NRI having an Indian passport who has secured admission to a recognized institution in Indian or abroad through an entrance test or merit-based selection. Moreover, the candidate should have passed 10+2 or equivalent from an accredited board of education with 50% marks.

Synd Super Vidya

The Scheme is aimed at exceptionally meritorious students who have been accepted by a reputed institute for extending educational loans with special provisions. The courses accepted under this scheme are technical courses and postgraduate courses offered at premier institutes.

Synd Vidya Vocational Courses

The candidate applying for this loan scheme must be a citizen of India who has passed the 10th exam and has secured admission to a government-recognized vocational training course program that is employment oriented. It is for candidates interested in pursuing certificate or diploma courses at the state or central universities in India.

Synd Vidya Skill Loan

The candidate must be an Indian citizen enrolled in courses offered by ITI or polytechnics or in a school recognized by the Indian government.

Check out loans by the Government:

- Education Loan by Delhi Government

- Education Loan Scheme by Narendra Modi

- Education Loan for Abroad Studies by Indian Government

Syndicate Bank Education Loan Abroad

Syndicate Bank offers education loans for students who wish to apply to abroad universities as well. Here is the loan scheme that they offer:

Synd Vidya Abroad Loan Scheme

The candidate applying for Synd Vidya Abroad Education Loan should be a citizen of India or an NRI having an Indian passport who has secured admission for abroad studies through an entrance test or merit-based selection. Also, the candidate is required to have cleared 10+2 or equivalent from a recognized board of education with 50% marks.

Expenses Covered Under Student Loan

Below is a list of major expenses covered under the Syndicate Bank Student Loan:

- Tuition Fee

- Library or Laboratory Fee

- Hostel Fee

- Examination Fee

- Travel Expenses

- Cost of Books, Equipment, Instrument or Uniforms

- Computer or Laptop Costs (if needed)

- Other Miscellaneous Expenses include study tours, project work, thesis, etc.

Courses Covered

There is a range of courses covered under the Syndicate Bank Education Loan with Synd Vidya Loan Scheme for Post Graduation or Doctorate or PG Diploma programs and Synd Vidya Abroad Loan Scheme for Graduation or Post Graduation programs.

Various job-oriented professional or technical courses offered by reputed universities include the following:

- Post-graduation: MCA, MBA, MS, etc.

- Courses conducted by CPA in the USA, CIMA-London, etc.

- Degree/Diploma courses like Pilot Training, Aeronautical, Shipping etc., provided these are accredited by the Director-General of Civil Aviation or Shipping in India.

How to Apply for Education Loan in Syndicate Bank?

Students or working professionals interested in acquiring an education loan from Syndicate Bank can either apply online or offline. The offline process for a loan application is quite simple. You can directly visit the nearest Syndicate Bank branch and ask for an education loan application form. Moreover, the bank representative will guide you with all the necessary information and documents regarding eligibility and also which loan is best suitable for you.

Or you can follow the online application process for Syndicate Bank Education Loan. Here is a step-by-step process for online application:

- Visit the official website of Syndicate Bank and select the loan scheme and then click on ‘apply now’.

- Fill in your details carefully and then upload the required documents.

- Submit the application form and take a printout of the application.

- You may also visit the bank branch for further formalities.

Syndicate Bank Education Loan Documents

An applicant is required to submit the below-mentioned documents while applying for the loan:

- Two recent passport-size photographs of the applicant, co-applicant and guarantor.

- Admission Letter including fee structure, mark sheets and related documents.

- Copies of ID proof and residence proof including Aadhar, PAN, etc.

- Marksheet of the recently qualified public exam (including school and college in India).

- Filled ‘Form 16’ along with recent salary slips.

- Schedule of course expenses.

- Details like transfer certificate and fee receipts.

EMI Payment Methods

Here are the ways you can make EMI Payments:

- Standing Instruction: This type of EMI is the best for you if you have an existing account at the company. The EMI account will be automatically debited from your account every month.

- Electronic Clearing Service: This type of EMI is good for those who do not have a Syndicate Bank and would like their EMI to be debited automatically at the end of every monthly cycle.

- Post-Dated Cheque: You can submit post-dated cheques from a non-Syndicate bank account at your nearest Syndicate Bank loan centre.

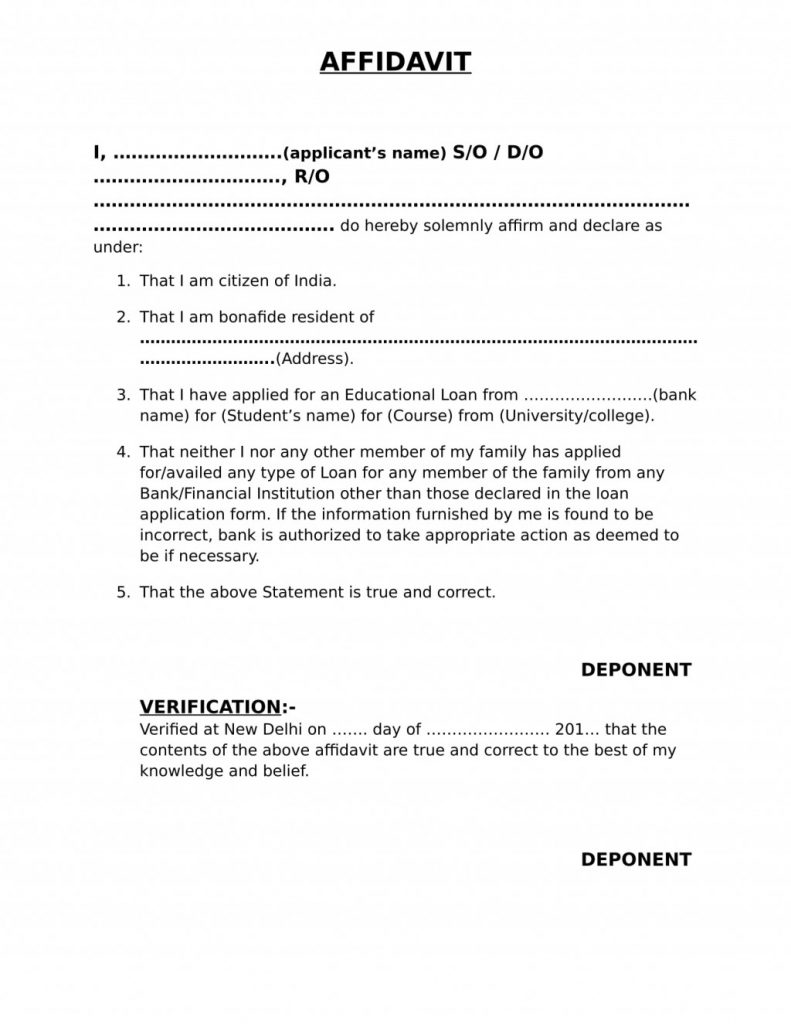

Syndicate Bank Education Loan Affidavit Format

How to Check Education Loan Status in Syndicate Bank?

To check the status of an education loan in Syndicate Bank, applicants have to contact the bank directly and ask for the status or by creating an account on the Syndicate Web Portal. The contact details for the Bank are given down below.

Syndicate Bank Education Loan Repayment Policy

The maximum tenure for loan repayment for the Synd Vidya Abroad is 15 years. The repayment policy of Syndicate Bank allows for a grace period called the moratorium period. The maximum extension offered by a moratorium is one year. For more information, candidates can contact the bank directly and request information. The contact details for Syndicate Bank are given below.

Syndicate Bank Education Loan Calculator

An EMI calculator is the easiest way to calculate your EMI instalments and make timely payments to the bank. It helps you calculate the amount owed, your outstanding principal amount, and your outstanding interest amount.

For instance, if you have applied for the Synd Vidya Abroad Loan for the amount of INR 20 lakh with an interest rate of 10.25 % with a tenure of 15 years then your outstanding amount – EMI Payable amount is INR 21,492 per month, the Total Interest – INR 18,68,560 and Payable Amount – INR 38,68,560.

Syndicate Bank Education Loan EMI Payment Methods

These can be repaid in 3 ways:

- Standing Instruction – The ideal method of repayment if you have an account with Syndicate Bank already is to use a standing instruction. At the conclusion of each month’s cycle, an automated debit will be made from the Syndicate Bank account you’ve designated to pay your EMI amount.

- Electronic Clearing Service – This mode can be used if you have a non-Syndicate Bank account and would like your EMIs to be debited automatically at the end of the monthly cycle from this account.

- Post-Dated Cheques – You can submit post-dated EMI cheques from a non-Syndicate Bank account at your nearest Syndicate Bank Loan Centre. A fresh set of PDCs will have to be submitted in a timely manner. Please note Post Dated Cheques will be collected at non-ECS locations only.

Syndicate Bank Education Loan Customer Care Number & Contact Details

| Address | Registered Office Door No. 16/355 & 16/365A Manipal – 576 104 Udupi District Karnataka State (India) |

| Complaint Portal | https://ogrs.syndicatebank.in/customerlogin |

| Toll-free Number | 1800 208 3333 | 1800 3011 3333 (24×7) |

FAQs

Ans. The bank offers different types of loans such as

Synd Vidya Educational Loan

Synd Vidya Abroad Educational Loan

Synd Super Vidya

Synd Vidya Vocational Courses

Synd Vidya Skill Loan

Ans. Syndicate Bank offers a variety of education loans and the interest rate for each education loan is different. The interest rates start at 8.25% per annum

Ans. A margin amount refers to the amount the bank does not pay to the borrower. The borrower has to pay that amount through other sources. For instance, in the case of Synd Vidya Education Abroad, the margin is 10% which means that the bank will pay 90% of the expense.

Ans. Candidates can apply for the loan online or offline.

Learn about different types of education loans with Leverage Edu and Fly Finance.

One app for all your study abroad needs

One app for all your study abroad needs

45,000+ students realised their study abroad dream with us. Take the first step today.

45,000+ students realised their study abroad dream with us. Take the first step today.