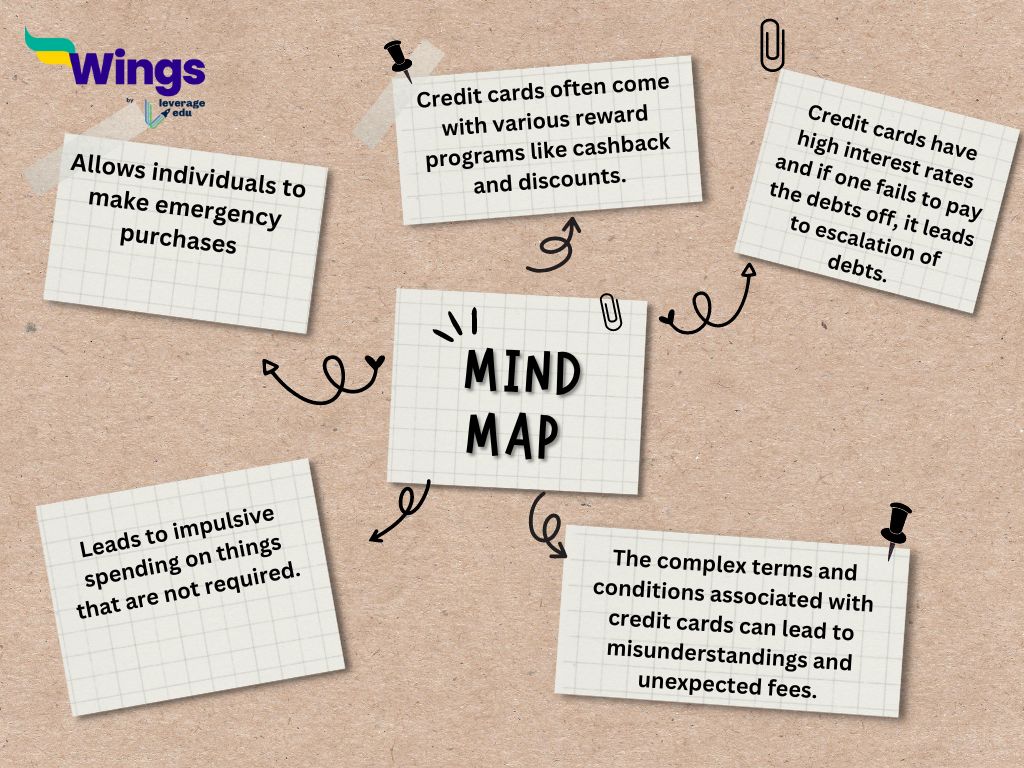

Brainstorming Ideas

Advantages of credit cards:

- Allows individuals to make emergency purchases

- Credit cards often come with various reward programs like cashback and discounts.

Disadvantages that outweigh advantages:

- Credit cards have high interest rates and if one fails to pay the debts off, it leads to escalation of debts.

- This leads to impulsive spending on things that are not required.

- The complex terms and conditions associated with credit cards can lead to misunderstandings and unexpected fees.

Q. Credit cards make people indebted. Does the advantage of credit cards outweigh their drawbacks?

Ans: The emergence of credit cards has revolutionised modern finance, offering unprecedented convenience and purchasing power to people. However, owning credit cards brings more problems than benefits, as they encourage impulsive buying, lead to high-interest debt accumulation, and often come with complex terms and unexpected fees.

One of the advantages of credit cards is that they allow individuals to make emergency purchases when they do not have immediate funds available. It is particularly beneficial in urgent situations such as medical emergencies or unforeseen travel needs. Moreover, credit cards often come with various reward programs, including cashbacks and discounts, which can provide substantial financial benefits to diligent users.

However, the disadvantages of credit cards can not be overlooked. The most significant drawback is the potential for accumulating debt. Credit cards have substantial interest rates, and failing to pay off the balance can result in an escalation of debt. This is particularly concerning for individuals with poor financial discipline or those who use credit cards to afford a lifestyle beyond their means. Moreover, access to credit cards leads to impulsive spending if they are not using tangible money, it is a high possibility for them to make unnecessary purchases which will further lead to debt accumulation. For instance, a person might be tempted to buy luxury items on credit, which they would not consider if they had to pay in cash. Additionally, the complex terms and conditions associated with credit cards can lead to misunderstandings and unexpected fees, further exacerbating financial strain.

To conclude, while credit cards offer certain advantages such as financial flexibility and rewards, their disadvantages, particularly the risk of debt accumulation and financial instability, are more significant. Therefore, individuals must be aware of these risks and exercise caution when using credit cards to avoid the detrimental effects on their financial health.

Analysis

Paraphrased Statement: The emergence of credit cards has revolutionised modern finance, offering unprecedented convenience and purchasing power to people.

Thesis Statement: However, owning credit cards brings more problems than benefits, as they encourage impulsive buying, lead to high-interest debt accumulation, and often come with complex terms and unexpected fees.

Body Paragraph 1-Topic Sentences: One of the advantages of credit cards is that they allow individuals to make emergency purchases when they do not have immediate funds available.

Body Paragraph 1- Supporting Reasons and Explanations: It is particularly beneficial in urgent situations such as medical emergencies or unforeseen travel needs. Moreover, credit cards often come with various reward programs, including cashbacks and discounts, which can provide substantial financial benefits to diligent users.

Body Paragraph 2- Topic sentence: However, the disadvantages of credit cards can not be overlooked. The most significant drawback is the potential for accumulating debt. Credit cards have substantial interest rates, and failing to pay off the balance can result in an escalation of debt.

Body paragraph 2- Supporting Reasons and Explanations: This is particularly concerning for individuals with poor financial discipline or those who use credit cards to afford a lifestyle beyond their means. Moreover, access to credit cards leads to impulsive spending if they are not using tangible money, it is a high possibility for them to make unnecessary purchases which will further lead to debt accumulation. For instance, a person might be tempted to buy luxury items on credit, which they would not consider if they had to pay in cash. Additionally, the complex terms and conditions associated with credit cards can lead to misunderstandings and unexpected fees, further exacerbating financial strain.

Conclusion: To conclude, while credit cards offer certain advantages such as financial flexibility and rewards, their disadvantages, particularly the risk of debt accumulation and financial instability, are more significant. Therefore, individuals must be aware of these risks and exercise caution when using credit cards to avoid the detrimental effects on their financial health.

Vocabulary in Use

| Word | Meanings |

| Unprecedented Convenience | Exceptional ease or comfort never experienced before. |

| Indebted | Owing money. |

| Impulsive Buying | Making unplanned purchases without careful consideration. |

| Unforeseen | Not anticipated or predicted. |

| Substantial | Significant or considerable in amount. |

| Accumulating | Gradually gathering or increasing in quantity. |

| Escalation | A rapid increase or intensification. |

| Tangible | Perceptible by touch; clear and definite. |

| Exacerbating | Making a situation worse. |

Linkers and Connectors Used

Following are the linkers and connectors used:

- However

- Moreover

- Additionally

- For instance

- To conclude

- Therefore

Are you preparing for IELTS? Check out this video to improve your writing skills for the IELTS exam given below👇.

Download the Leverage IELTS App today.

Need help preparing for IELTS? Check out the best IELTS preparation courses in the market offered in a live training environment.

One app for all your study abroad needs

One app for all your study abroad needs

60,000+ students trusted us with their dreams. Take the first step today!

60,000+ students trusted us with their dreams. Take the first step today!