The difference between covariance and correlation is that correlation assesses the strength and direction of the linear link between two variables, while covariance just shows the direction of the relationship. So, the covariance determines the correlation.

Table of Contents [show]

What is Covariance?

Covariance is the measure of changes between two random variables in statistics. This table provides an overview of covariance, covering its definition, calculation, importance, relationship with risk, types, and differences from correlation.

| Definition | Covariance measures the directional relationship between returns on two assets. Positive means they move together, and negative means they move inversely. |

| Calculation | Covariance is calculated by analysing return surprises or multiplying correlation by the standard deviations of each variable. |

| Importance | It’s a tool in modern portfolio theory for diversification, determining securities to include in a portfolio. |

| Relationship with Risk | Pairing assets with negative covariance helps reduce risk and volatility in a portfolio. |

| Types | Positive covariance indicates variables move together; negative covariance indicates an inverse relationship. |

| Difference from Correlation | Covariance measures the direction of the relationship, while correlation measures strength. |

Must Read:Difference Between Parallel and Perpendicular

What is Correlation?

A correlation is a statistical measure that indicates the extent to which two or more variables fluctuate concerning each other. This table provides an overview of correlation and its application, including its calculation methods and types.

| Definition | Correlation measures the degree to which two or more variables move in sequence. A correlation matrix displays correlation coefficients between variables . |

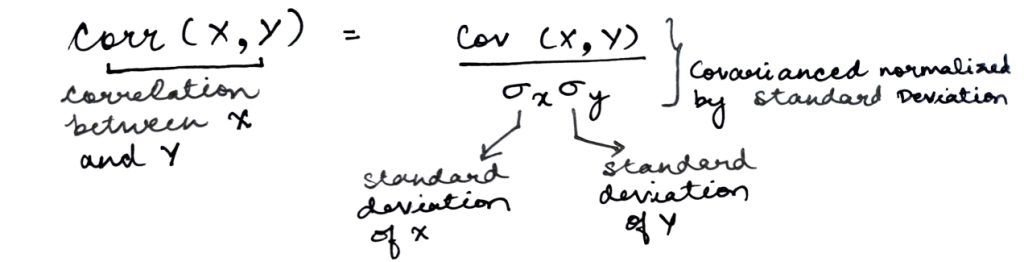

| Calculation | The correlation coefficient is calculated by dividing the covariance of two variables by the product of their standard deviations. |

| Types | Used in data analysis to understand relationships between variables. The correlation matrix helps summarize relationships and guide further analysis. |

| Application | Used in data analysis to understand relationships between variables. Correlation matrix helps summarize relationships and guide further analysis. |

| Methods of Calculation | Common methods include coefficient of correlation, rank correlation coefficient, and coefficient of concurrent deviations. |

Must Read: Difference Between Marginal Cost and Average Cost

What is the Difference Between Covariance and Correlation

Despite the similarities between these mathematical terms, they are different from each other. Covariance is when two variables vary with each other, whereas correlation is when a change in one variable results in a change in another variable. Here we have differentiated both terms based on the following parameters :

| Feature | Covariance | Correlation |

| Definition | Measures the direction and magnitude of linear dependence between two variables. | Measures the strength and direction of the linear relationship between two variables. |

| Values | Range: -∞ to +∞ | Range: -1 to +1 |

| Change in Scale | Affected by the scale of the data. | Unaffected by the scale of the data (standardised). |

| Unit-free measure | No | Yes |

Covariance and Correlation Formulas

Covariance explains the joint variability of the variables. This table provides an overview of covariance calculation, interpretation, and its formula:

| Covariance Calculation | Covariance is calculated by summing the product of the deviations of returns from their means, then dividing by the sample size minus one. |

| Example Calculation | Calculate the covariance between two stocks using daily returns over a period. Deviations from means are multiplied and averaged. |

| Interpretation | Positive covariance suggests similar movements between assets. A covariance of zero indicates no clear directional relationship. |

| Covariance vs. Variance | Covariance measures the relationship between two variables, while variance measures how closely data points are clustered around the mean in a single variable. |

| Mathematical Formula | Covariance = Σ [ (Returnabc – Averageabc) * (Returnxyz – Averagexyz) ] ÷ (Sample Size – 1) |

Correlation measures the association between the variables. Here we have stated the formula showing its relationship with covariance.

Application of Covariance and Correlation in Real Life

Covariance and correlation are often used in real life. From finding patterns to diagnosing issues covariance and correlation have numerous advantages to offer:

- Finding patterns: Correlation helps identify relationships between data points. A “correlation matrix” reveals if multiple variables move together (positive correlation) or oppositely (negative correlation). This uncovers hidden trends in large datasets.

- Enabling further analysis: Correlation matrices act as a springboard for other techniques. They feed into methods like factor analysis and regression, which explore deeper connections and make predictions based on the correlations found.

- Diagnosing issues: A correlation matrix can also act as a check. In linear regression, extensive correlations between variables flag potential problems. This helps identify situations where the analysis might be unreliable.

FAQ’s

Covariance measures the directional relationship and magnitude between variables. Correlation standardises covariance, indicating the strength and direction of the relationship.

Correlation measures the degree and direction of association between two variables. Variance measures the spread or dispersion of data points around the mean.

The three types of correlation are positive correlation (direct relationship), negative correlation (inverse relationship), and zero correlation (no relationship).

This was all about the “Difference Between Covariance and Correlation”. For more such informative blogs, check out our Study Material Section, you can learn more about us by visiting our Indian exams page.

One app for all your study abroad needs

One app for all your study abroad needs

45,000+ students trusted us with their dreams. Take the first step today!

45,000+ students trusted us with their dreams. Take the first step today!